As the new year dawns, businesses and individuals alike are looking for fresh opportunities to thrive and grow. In the ever-changing landscape of finance, Groves Capital stands out as a beacon of hope, offering innovative products and services to meet the evolving needs of its clients.

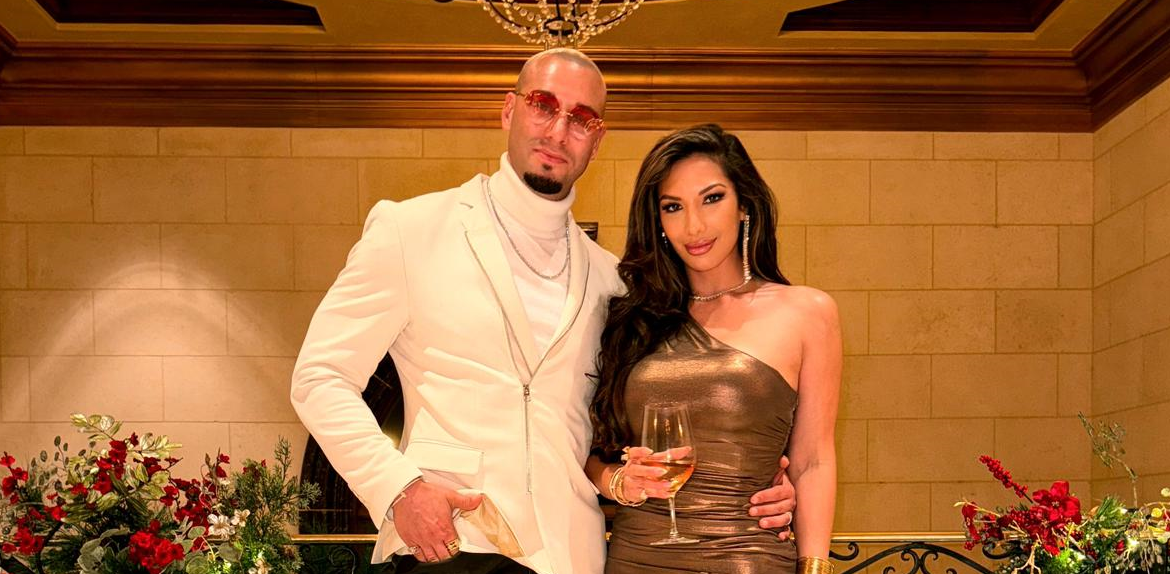

Chris Groves and his wife Aleyna Groves are the power couple behind Groves Capital, one of the fastest growing mortgage companies in the United States. Groves Capital prides itself on pioneering commercial lending in the nation as well as out of the country.

With a focus on the refinance boom and new product offerings, Groves Capital is poised to make a significant impact in the financial market in the coming year. The refinance market is experiencing a surge in activity, presenting a prime opportunity for individuals and businesses to optimize their financial situations.

Groves Capital recognizes the potential of this market and is prepared to assist clients in navigating the refinance process with ease and efficiency. Chris emphasizes the importance of seizing opportunities in times of crisis, he believes that challenges present unique opportunities for growth and innovation.

By adopting a positive mindset and focusing on finding opportunities amidst adversity, Groves Capital is well-positioned to capitalize on the refinance boom and help clients achieve their financial goals.

“There is always money to be made in any economic environment. Some of the biggest wealth is built during downturns and changing markets. The key is change, the one constant to stay on top of any industry, is the ability to change and move quickly,” Chris comments.

In addition to capitalizing on the refinance boom, Groves Capital is expanding its product offerings to better serve its clients.

“We developed new commercial platforms in all 50 states, we have seen an increase in investors looking to build their portfolios and a down-turn market is perfect to do just that,” Chris says.

Through a recent partnership with Glenn Stearns, owner of Kind Lending, Groves Capital has gained access to new and unique product options with competitive pricing.

“We are confident that we not only have every product to help our clients but the best pricing and our focus will remain on our clients experience,” Chris shares.

This partnership enables Groves Capital to offer a diverse range of financial products tailored to the specific needs of its clients. From commercial lending to hard money loans, Groves Capital provides lending opportunities that many traditional banks may overlook.

With a focus on delivering exceptional value and customer experience, Groves Capital is committed to ensuring that clients receive the best possible service and support.

Chris Groves underscores Groves Capital’s commitment to excellence and customer satisfaction. He emphasizes that the company’s focus will always remain on providing top-notch products and services, backed by a dedication to delivering a five-star experience with every transaction.

In the spirit of perseverance and resilience, Chris believes that challenges are merely opportunities in disguise. Chris embodies the latter mindset, always looking for opportunities to bring positivity and innovation to the forefront.

Explore how Groves Capital’s innovative products can help you capitalize on the refinance boom. Take action today to secure your financial future!

About Groves Capital

Groves Capital is a San Diego, California-based company offering tailored financial solutions to ambitious entrepreneurs. This family-owned residential and commercial lending company exemplifies the transformative impact of entrepreneurship. Groves Capital is known for their diverse services, excellent customer service, and quick turnaround, Groves Capital’s mission is unique: to empower businesses by offering them a wide range of financial services tailored to their specific needs.